Debt snowball refers to a method of debt repayment in a form of debt management, in which the borrower categorizes every debt of him from smallest to largest (excluding the mortgage), then pay additional money to each payment to pay off the smallest debt initially, whereas, making only minimum monthly payments on all other debts. While, debt snowball spreadsheet refers to calculate your debt snowball using Microsoft excel spreadsheet, because spreadsheet provides you the better way to compose or calculate your debt snowball.

The debt snowball spreadsheet usually created to pay-off credit card loans. Under debt snowball method, extra cash (after making budget) is given over to paying debts with the smallest amount to be paid. When each debt is repaid completely, the monthly money then used to make additional payments on the second smallest debt and so on till all the obligations are paid in full. Debt snowball is a very common practice to handle multiple debts even if larger debts have larger interest rates.

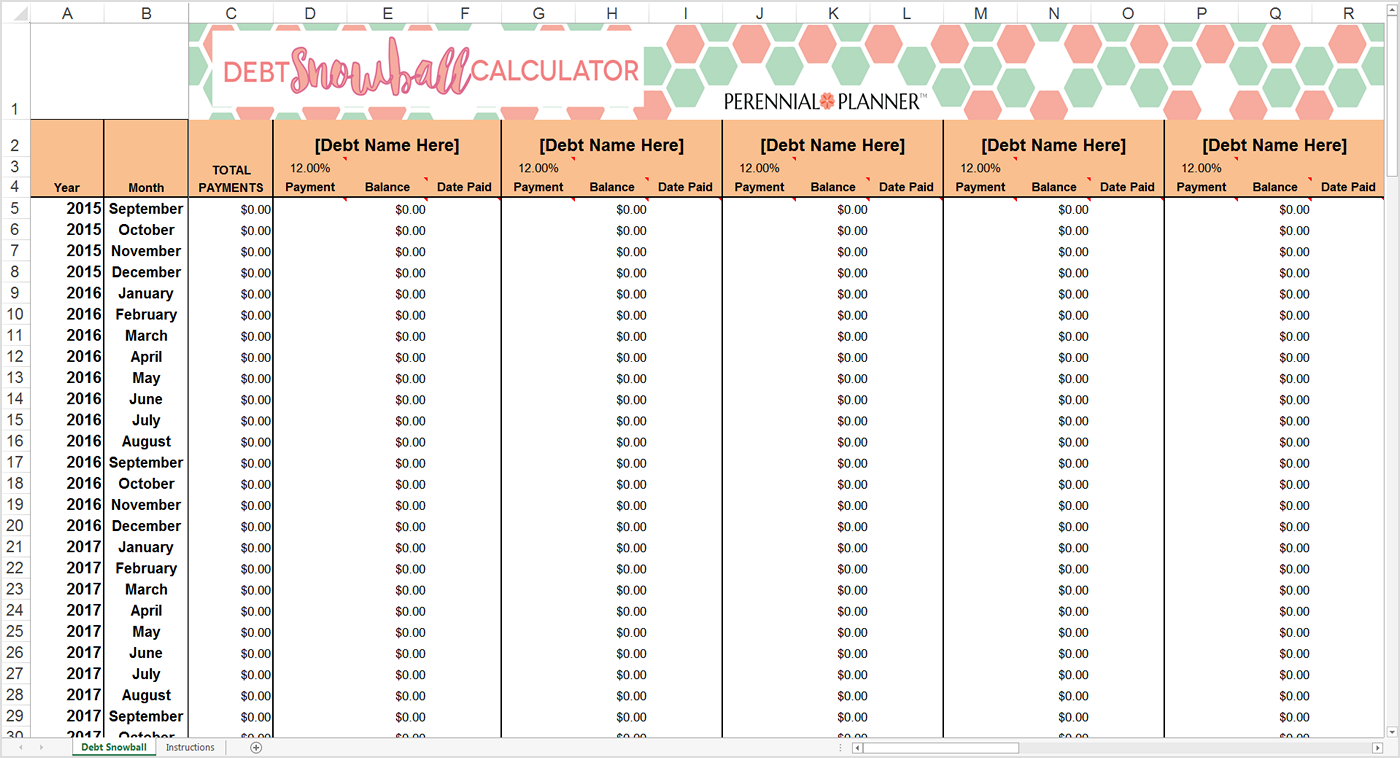

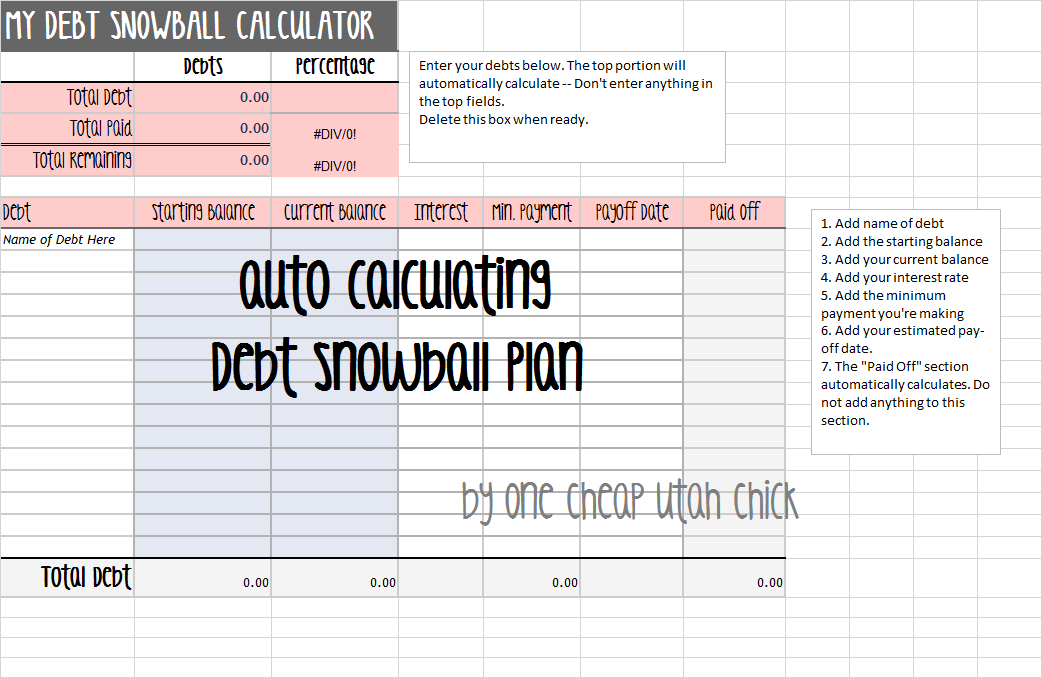

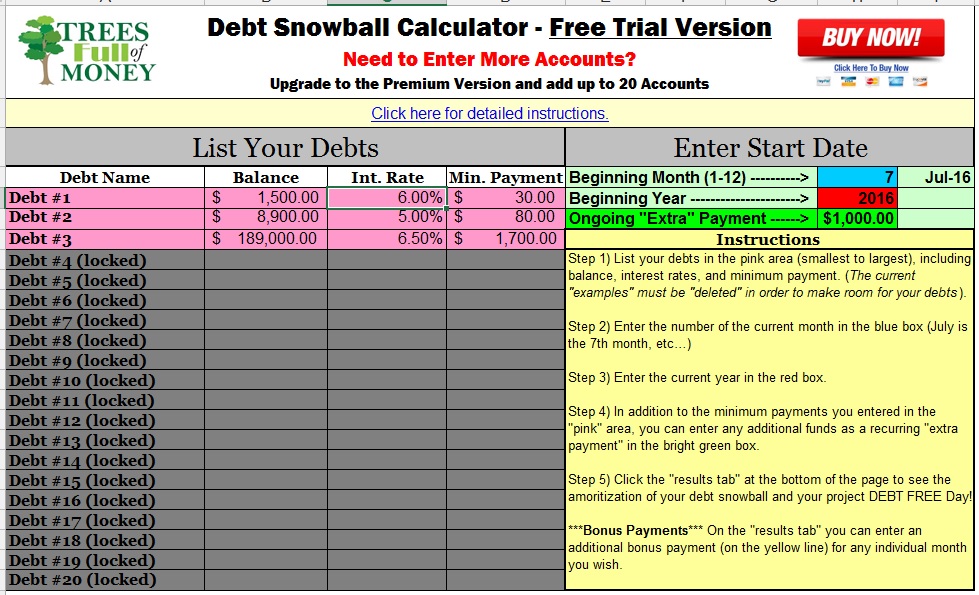

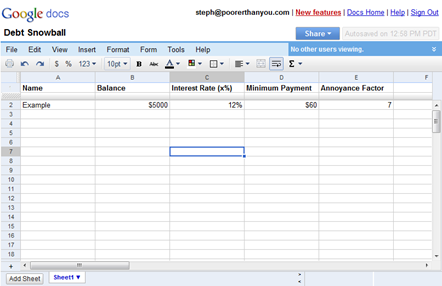

By using debt snowball spreadsheet you can easily calculate your repayments, in order to do this you will have to list all your debts in ascending order from smallest amount to largest, execute to pay the minimum payment on each debt, pay the minimum amount including the additional amount to the smallest debt until it is fully paid. Once a debt paid fully, add older minimum payment on the second smallest debt repeat it, till all the debts are paid off. Download and try our debt snowball spreadsheet formats and eliminate your debts without any complications.

Find Debt Snowball Spreadsheets Below

You must be logged in to post a comment.